Interest rates are at historically low levels providing opportunities for borrowers to establish a worst case interest rate at attractive levels.

But a recent spate of improved economic data is indicating that fixed rates may be on the rise in the near future. This leaves borrowers with a limited time to take advantage of low fixed rates for terms between three and five years.

Business borrowers generally select either a standard variable or fixed rate loan. Their decision depends on their interest rate view and the certainty of their cash flow forecasts. A variable rate entitles the borrower to benefit from interest rate declines whilst providing them with the opportunity to pay down and draw up debt according to their business needs. Standard fixed rate loans protect the borrower from rising interest rates and provide certainty for future interest payments, but do not permit the borrower to benefit from declines in interest rates.

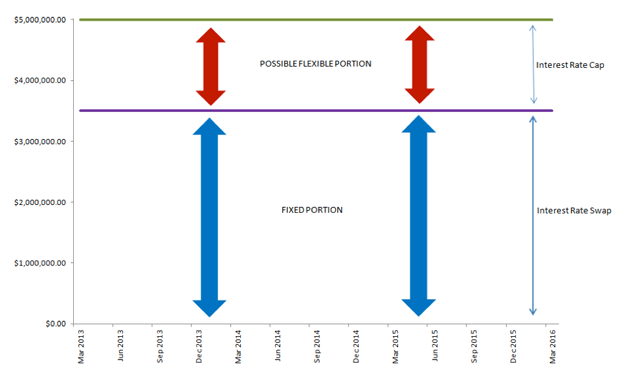

There are benefits and disadvantages to both of the approaches mentioned above, but these can be overcome by implementing an interest rate risk management strategy which incorporates both the flexibility of a variable rate loan and the certainty of a fixed rate loan. A strategy which can be tailored to a businesses real life cash flow can be referred to as a ‘blended solution’ (see the diagram below).

The diagram above is an example of a ‘blend solution’. The borrower has a $5m interest rate risk management strategy, with $3.5m locked in at a rate of X and another $1.5m worth of floating debt which is capped at the fixed rate of X. This ensures that the borrower can derive some benefit from falling rates whilst also providing the inbuilt flexibility to come and go with the debt under the cap. Note: All premium costs for the cap are built into the worst case interest rate. A break cost or benefit may be payable on termination.

Suncorp representatives can help clients with the above or alternative strategies that meet your specific business needs. Please contact Chris Britton (0434 363 648) or his team – Tanya Mehinagic (0459 808 331) or Larry Pumpa (0418 886 459) to enquire about Suncorp interest rate risk management strategies.

The information provides a general summary and has been prepared without taking into account any individual particular objectives, financial situation or needs. No action should be taken in reliance upon the information in the Interest Rate Risk Management document without consideration of the appropriateness of the information to any individual particular objectives, financial situation and needs and without first seeking expert financial advice.

by Jordan Karlos, Financial Markets Analyst – Suncorp